By Ethan Soloviev and the Regenerative Economy Collaborative; originally published on Medium.

I have previously documented the funds that explicitly state they are investing in regenerative agriculture (here and here). But is their approach to investing in and of itself regenerative?

Consider the following conceptual framework, which describes the Four Levels of Paradigm that underlie (usually unconsciously) the thinking and actions of investors around the world. While most food systems investors, philanthropists, and funds can quickly tell you what they invest in, it is much rarer for them to be able to describe how they invest and the way it is shaped by their paradigm — especially the deeper why that motivates their behavior and decision-making.

This article explores the ways that unconscious paradigms shape the why, how, and what of food systems investing. Along the way, I invite you to consider: which of these paradigms sources your investment decisions? What would you change if you were to work from a different level?

Value Return

The underlying motivation of investors working from the Value Return paradigm is to generate a single-bottom-line return on invested capital. The means of obtaining this return, and the impacts that get created, the way the return is obtained, are inconsequential compared to “getting more back than I put in” — ideally, 10–1000x more.

The financial enrichment of an individual, firm, or institution (including governments) is often a parallel motivator. Many times food systems investors working from the Value Return paradigm are not even interested in food or agriculture per se, but see food companies or agribusinesses as attractive opportunities for the significant financial capital returns that can be obtained by extracting value from land, laborers, and living systems.

Value Return investors and funds tend to focus on a single phase of the larger value-adding stream that produces, processes, productizes, packages, and purveys food. Farmland funds buy agricultural land with predictable (or projected) high-yielding crops. Natural product industry investors look for emerging food categories, superior flavors, and opportunities for rapid scale to acquisition. Entities sourcing their thinking from this paradigm are often dismissive of concerns about negative impacts of their investments, assuming that larger market forces will address these problems and preferring to focus on their own economic gain instead of resulting externalities.

Functionally, the investment approaches that emerge from Value Return thinking focus on the best bets for 10x, 100x, or 1000x return on financial capital generated. This leads to food and agriculture investments that prioritize short-term gains: For example, businesses that profit from razing intact forest ecosystems to produce beef cattle, palm oil, or sugar; companies that scale up a trending food product category that relies on ingredients from extractive agriculture (like meat-heavy keto diets or sugar-laced CBD drinks). Venture capital funds are organized around fast growth, or algorithms to trend-spot the companies and product categories that will deliver the highest rates of return.

Arrest Disorder

The primary driver of investment decision-making in the Arrest Disorder paradigm is how to profit from efficiency and optimization. Whether the promise is of lean business operations, technological advances in efficiency, or reduced resource consumption, this investing paradigm aims to waste less and thereby generate returns.

How Arrest Disorder-based investors operate is again tied to a single phase of the value adding process of food, although with a more comprehensive consideration of resource use and utilization.

Attractive food product investments are ones that offer reductions in effort or harm to the eater: faster/easier to consume, reduced sugar or fat or calories, decreased ethical concerns, or lower-impact impact ingredients. Specific examples are products like Soylent, “diet” sodas or low-alcohol beers, and plant-based foods like Impossible burgers or OmniPork.

Agricultural production investments focus on ag-tech efficiencies: reduced pesticide usage, decreased water requirements, lower fertilizer inputs with greater yields, farm management software, and human labor-saving robots.

Supply systems efficiencies are also attractive targets:

- Big data and market-making software (e.g. Indigo Marketplace, AI-enabled commodities trading),

- Technologies to decrease food-loss and food-fraud (e.g. Internet-of-Things temperature/moisture sensors, blockchain solutions for immutable and public chain-of-custody records)

- Direct approaches to reducing food waste (e.g. Apeel biosciences, upcycled ingredients).

Efficient business models are also an important focus, including discounted online retail, direct-to-consumer offerings, and membership-based meal kit models.

In keeping with the overall orientation of Arrest Disorder, investors working within this paradigm are often defensive in tone about the importance and correctness of their approach. For example, investors in plant-based “meats”, which offer large reductions in environmental harm compared to industrial animal protein production, attack holistic rotational grazing approaches that go beyond environmental harm reduction and actually increase the health of soils and ecosystems. Plastics manufacturers defensively point to the greenhouse gas and water efficiency of their single-use packaging, despite public outcry against ocean pollution and the greater systemic potential of carbon-sequestering packaging materials derived from sustainable forestry.

Do Good

Food systems investors working from the Do Good paradigm are motivated by a sincere desire to create positive change. They have developed a concept of what “good” means, often encapsulated in vision/value statements that articulate their ideals as replacements for the current “bad” approaches to farming and business.

While philanthropists working within this paradigm are often content to drive change by giving their capital to values-aligned causes, some will partner with venture capitalists to seek investment opportunity sweet spots where they can generate financial capital returns and make the world a better place — “Doing well by doing good.”

In this paradigm, investors grow their understanding and awareness of different phases of the value-adding process of food. Ingredients are traced upstream to their sources from producer communities around the world, then downstream through manufacture, distribution,and consumption, with consideration given to the environmental and social impacts of each step of the process.

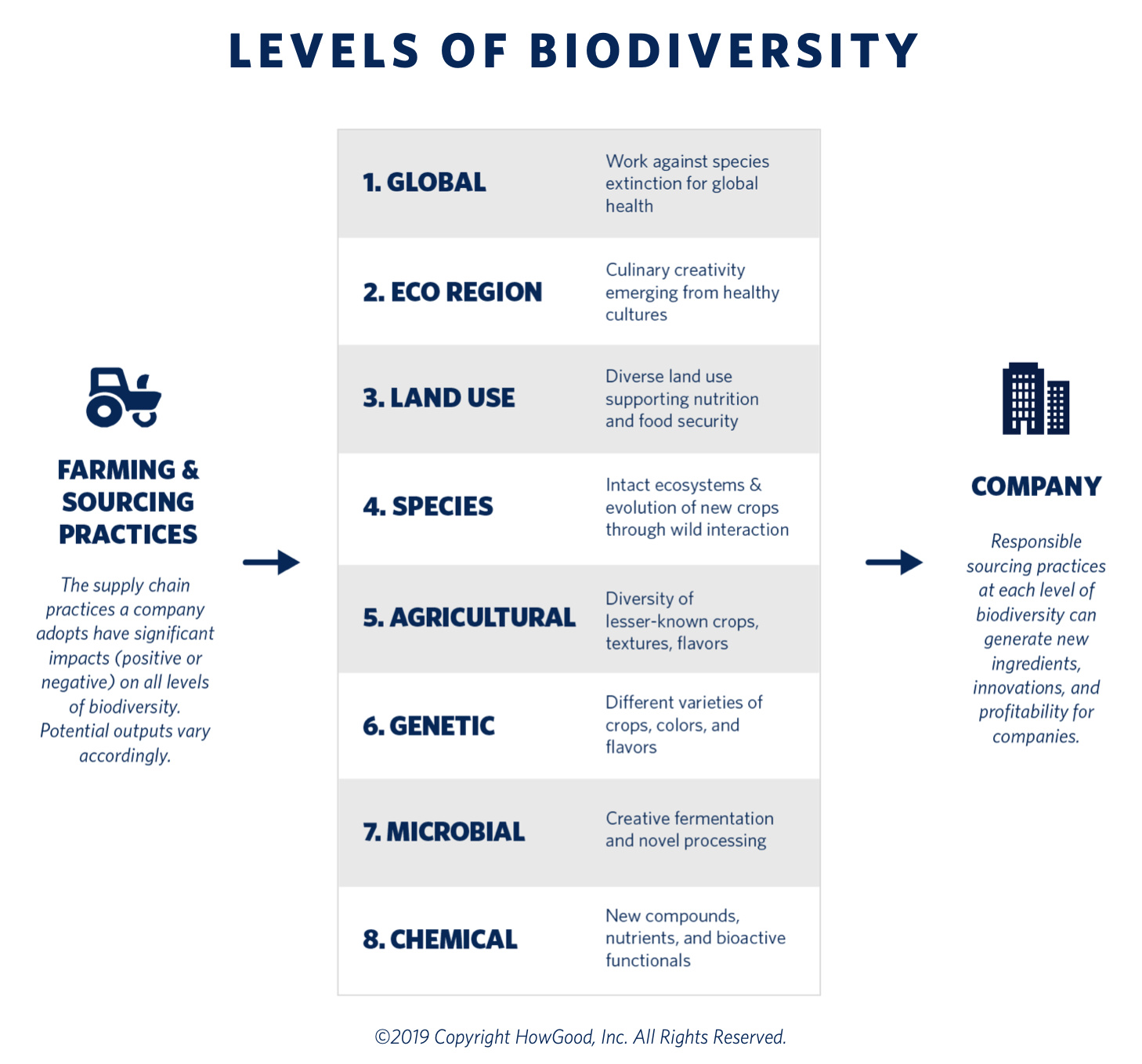

The longer-term health effects of each upstream phase are tracked downstream, from soil erosion and greenhouse gas emissions to persistent chemical accumulation; from energy-intensive processing of ingredients to synthetic preservatives; from extractive labor practices to environmentally toxic packaging to the resulting effects on human communities, ecosystem services, and global biodiversity.

Investors see and articulate the interconnectedness of food systems, and are determined to put their capital to work to “make things better” at multiple points in the process. They often feel connected at a personal level with the good they seek to create, truly seeking to invest their resources towards the betterment of something other than themselves.

In order to Do Good, investors focus on mission-driven or values-aligned food businesses, agricultural projects, and community development initiatives. Food products or restaurants that represent various approaches to healthy eating are excellent targets, especially when paired with initiatives to promote responsible or sustainable food production, sourcing, processing, and packaging.

Many diet-centric business models promote a Do Good image, although in practice the supply systems that generate the food they utilize may still be operating from Value Return or Arrest Disorder paradigms. When these inconsistencies are revealed to Do Good investors, they will work towards ameliorating them in their portfolios, seeking industry best practices and agricultural models that go beyond reducing harm.

Promoters of regenerative agriculture, much like early organic agriculture enthusiasts, are convinced that their approach to agriculture is truly good and that everyone should adopt it. Herein lies the shadow of the Do Good paradigm — someone must decide what is “good” and what is not. One person or group’s perspective on “goodness” is then projected onto other people and places, whether by religious missionaries, cause-fighting NGOs, or mission-driven companies.

Nonetheless, in food systems, many individuals can immediately and emotionally grasp the difference between reducing pesticide use (an idea from the Arrest Disorder paradigm) and increasing soil health (Do Good paradigm). The palpable difference between doing less of something bad and doing something good underlies the rapid growth of corporate and consumer demand for regenerative agriculture. But there are very few food systems actors, and even fewer investors, who are actually working from the Regenerate Life paradigm.

Regenerate Life

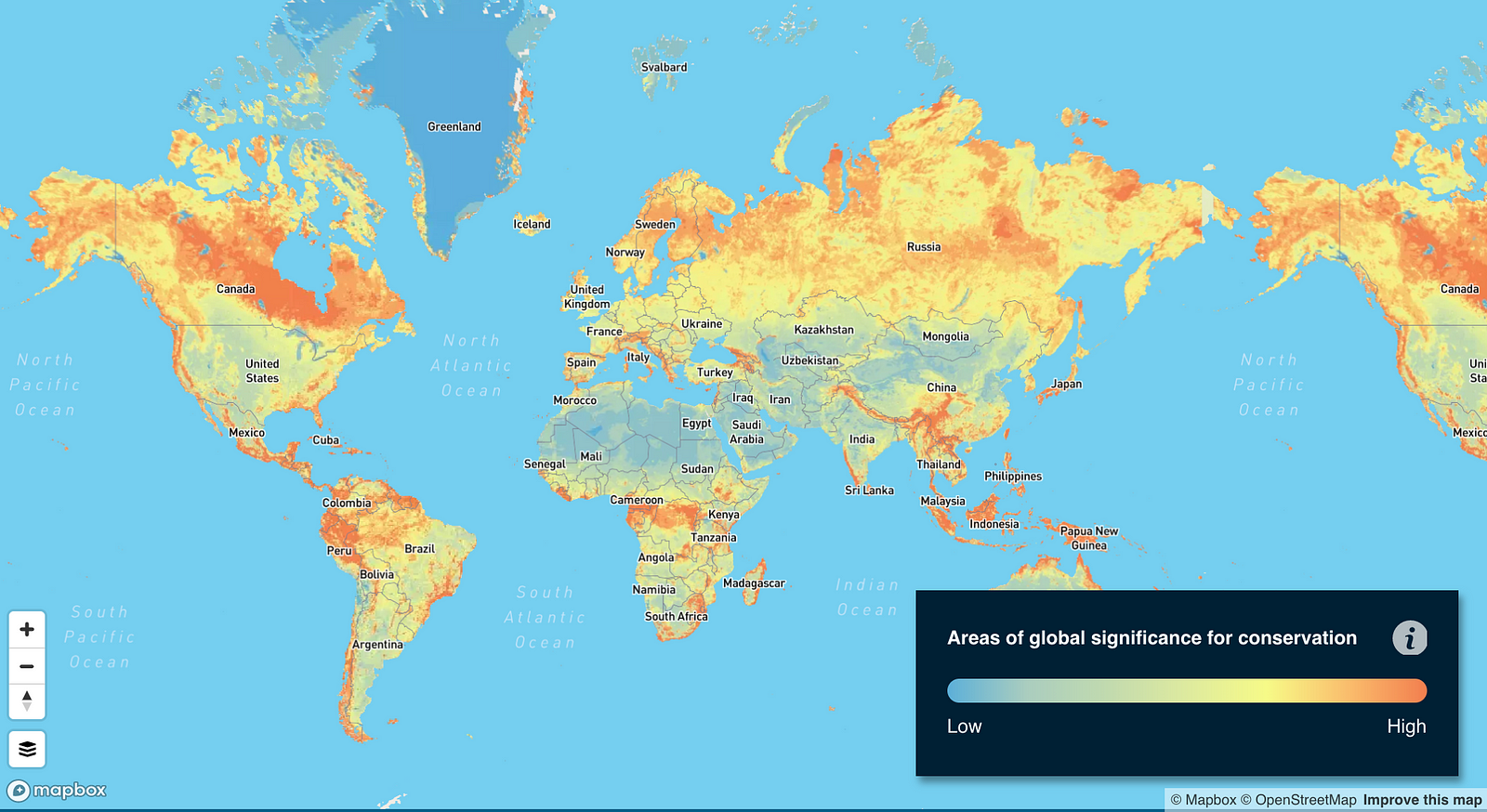

Investors sourcing their strategies and actions from the Regenerate Life paradigm aim to evolve the capacity of a whole place (usually a bioregion or life-shed), using the food system as a focused nodal entry point to initiate change. Through their investments they seek to reveal and express the essence of this place — it’s irreducible uniqueness or singularity, akin to a bioregional fingerprint or terroir, that arises from its socio-cultural-ecological-economic distinctiveness.

Instead of fixing problems, Regenerate Life investors focus on generating new potential — novel business models, innovative food products and eating innovations, new agricultural approaches, and enterprise ecosystems that are deeply in harmony with the long term story of the place.

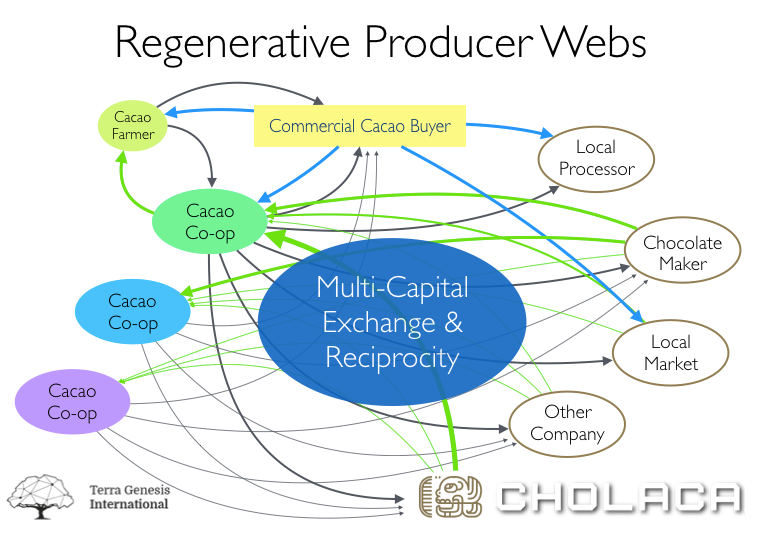

At this level of paradigm, investments and the entire process of investing are vectored toward growing a developmental community of food systems actors that ongoingly advance the vitality and quality of local intellectual, financial, and living capital. In many places this will mean that the focus of regeneration is not solely the environment where food is grown, but also the socio-cultural-culinary system that generates both the innovations and demand for the food itself.

This community simultaneously sees that its unique place is nested within larger ecoregions, climactic zones, and Earth herself — it perceives a functional global diversity, and works to cultivate reciprocal relationships with other unique places around the world.

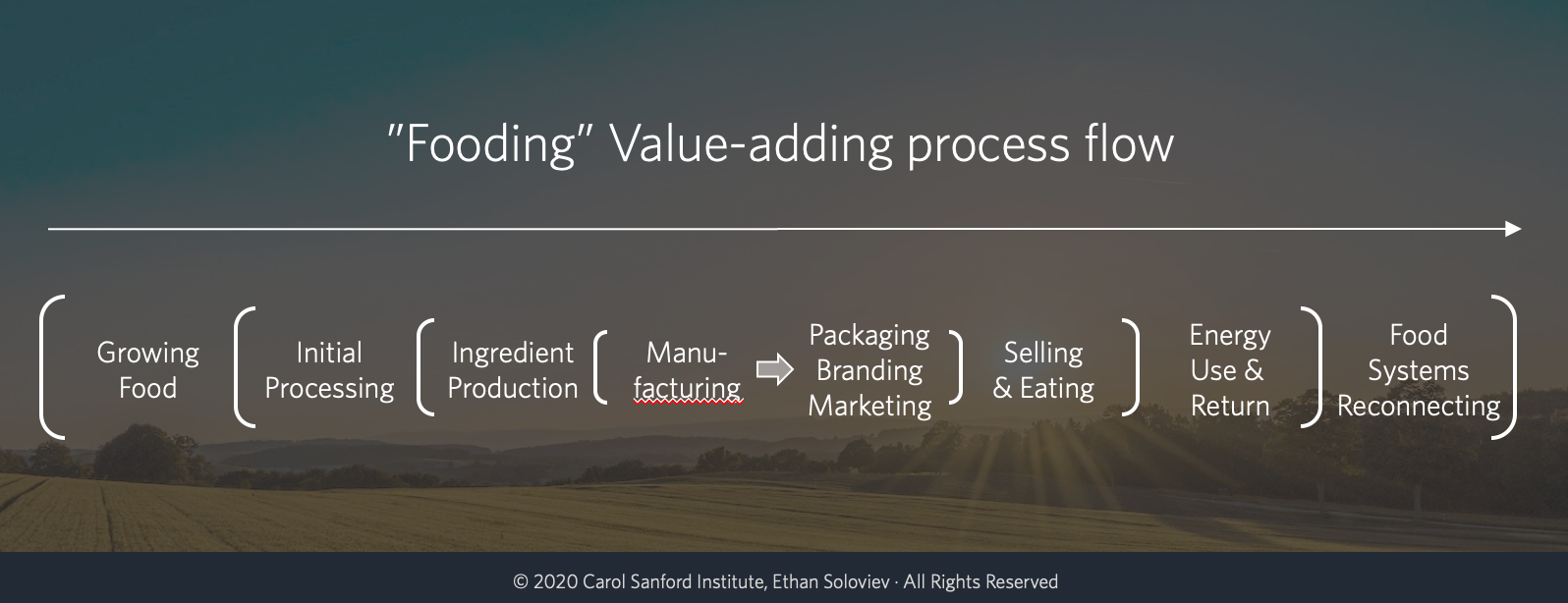

Investors whose aim is to regenerate life understand at a deep level how the fooding process works in a place. Not just food, which is a static and finished object to be consumed, but fooding — the whole living mosaic of interwoven processes that result in nourishment of all beings in a place. Here is one lens through which to consider the value-adding process of fooding as a whole:

Investments are made to grow the capacity of actors across all phases, or strategically targeted at specific phases that can unlock the potential of others.

On the surface, it would seem easy to suggest that investors working from the Regenerate Life paradigm would focus on businesses that are engaged in physical regeneration: regenerative agriculture or agroforestry enterprises (e.g. Ejido Verde), broadscale ecological land managers (e.g. Grasslands LLC), 3D regenerative ocean farmers (e.g. GreenWave); or food product companies that have made commitments to regenerative agriculture like General Mills, Danone, Patagonia Provisions, or dozens of others.

However in practice, individual investments will vary radically from investor to investor and place to place. In one bioregion a farmers cooperative and food processing hub might be the key to uplifting ecosystems and livelihoods, while a rural entrepreneurship incubator and culinary agritourism cluster might energize demand and market development in another.

Ultimately, investments at this level are not defined by what is invested in, but by their success in evolving human capacity and their ability to unlock the potential of a place or system.

Conclusion

In a regenerative economy, food systems investing does much more than generate financial capital returns (Value Return), reduce the harm of food product supply chains (Arrest Disorder), or promote practices that have small-scale positive impacts (Do Good).

The economy actively develops the capacity of all people, places, and organizations to be creative and consistent investors in their own food system, while simultaneously crafting conscious reciprocal relationships with the other place-sourced food-systems of the world. The economy’s policies, management, and infrastructure are designed to educate citizens and businesses, and to evolve the means of ongoing wealth-generation for all entities in a way that expresses the unique essence of each place.

In a regenerative economy,

- Investors work from a Regenerate Life Paradigm

- Local actors, including individuals, families, businesses, institutions, and other entities have the personal agency to see their every decision as an investment and therefore themselves as investors

- Communities, cities, and bioregions organize their resources to catalyze investment across all phases of the fooding value-adding process

After exploring the why, how, and whatof these four levels of paradigm, I invite you to consider the following questions: What paradigm are you currently investing from? What paradigm do you want your investors or LPs to be investing from? What would it take for you to evolve your collective approach? Where might you start?